During the initial half of 2023, the market dynamics for aluminum alloy ingots varied across regions. In Q1, the Asia-Pacific region maintained price stability, thanks to well-balanced inventories and consistent demand. However, the trend was disrupted in the following quarter due to declining production rates, increased inventories, and a drop in aluminum scrap prices. Despite challenges in Q2, overseas markets displayed positive sentiments amid sluggish demand and rising import costs.

In Europe, the first quarter witnessed stabilization driven by restrained supply and post-holiday demand from Asia. However, Q2 brought about a surge in prices fueled by constrained supply and robust demand from downstream industries. This positive momentum was dampened by crises in the US banking sector and a decrease in North American consumption.

In North America, sanctions on Russian imports supported Q1 prices, but Q2 faced challenges such as labor market fluctuations, weakened procurement, and financial crises that hindered upward trends.

Request for Real-Time Aluminium Alloy Ingot Prices: https://www.procurementresource.com/resource-center/aluminium-alloy-ingot-price-trends/pricerequest

Definition

Aluminium alloy ingots possess a combination of attributes that make them versatile in various applications. Their lightweight nature, coupled with good strength-to-weight ratios, renders them valuable in industries like automotive and aerospace. These ingots offer excellent corrosion resistance, making them suitable for outdoor and marine applications. Their malleability facilitates intricate shaping, enabling intricate designs in industries like construction and consumer goods. Aluminium alloy ingots exhibit effective thermal conductivity, benefiting heat exchange applications. With a range of alloy compositions available, these ingots can be tailored to specific mechanical, thermal, and corrosion requirements.

Key Details About the Aluminium Alloy Ingot Price Trend:

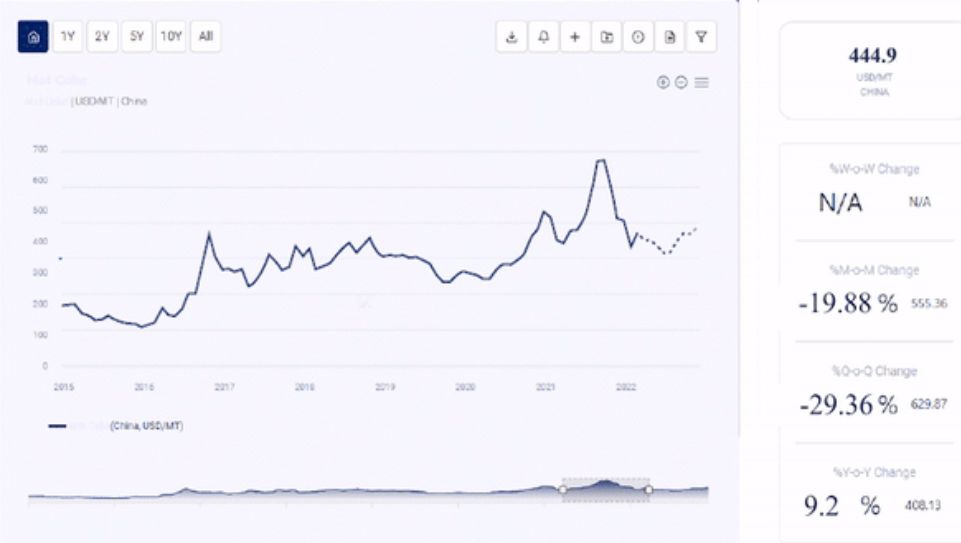

Procurement Resource does an in-depth analysis of the price trend to bring forth the monthly, quarterly, half-yearly, and yearly information on Aluminium Alloy Ingot in its latest pricing dashboard. The detailed assessment deeply explores the facts about the product, price change over the weeks, months, and years, key players, industrial uses, and drivers propelling the market and price trends.

Each price record is linked to an easy-to-use graphing device dated back to 2014, which offers a series of functionalities; customization of price currencies and units and downloading of price information as Excel files that can be used offline.

The Aluminium Alloy Ingot Price trend, including India Aluminium Alloy Ingot price, USA Aluminium Alloy Ingot price, pricing database, and analysis can prove valuable for procurement managers, directors, and decision-makers to build up their strongly backed-up strategic insights to attain progress and profitability in the business.

Industrial Uses Impacting the Aluminium Alloy Ingot Price Trend:

Aluminum alloy ingots are widely employed across a range of industries owing to their versatile properties. In the automotive sector, these ingots play a crucial role in manufacturing lightweight components that contribute to improved fuel efficiency and enhanced vehicle performance. In aerospace, their combination of strength and low weight is indispensable for crafting aircraft parts. The construction industry benefits from their corrosion resistance, utilizing them in roofing, windows, and structural elements. Moreover, the consumer electronics, packaging, and machinery sectors leverage aluminum alloy ingots for their malleability, electrical conductivity, and heat dissipation capabilities. The diverse alloy compositions available cater to specific needs, underscoring the pivotal role these ingots play in shaping contemporary industrial applications.

Aluminum alloy ingots are widely employed across a range of industries owing to their versatile properties. In the automotive sector, these ingots play a crucial role in manufacturing lightweight components that contribute to improved fuel efficiency and enhanced vehicle performance. In aerospace, their combination of strength and low weight is indispensable for crafting aircraft parts. The construction industry benefits from their corrosion resistance, utilizing them in roofing, windows, and structural elements. Moreover, the consumer electronics, packaging, and machinery sectors leverage aluminum alloy ingots for their malleability, electrical conductivity, and heat dissipation capabilities. The diverse alloy compositions available cater to specific needs, underscoring the pivotal role these ingots play in shaping contemporary industrial applications.

Key Players:

- Alcoa Inc.

- Rio Tinto Group

- Aluminium Corporation of China Limited

- RUSAL Plc

- Norsk Hydro ASA

News and recent development:

The price of aluminum increased by 0.74% to 210.1 as domestic societal inventories of aluminum ingots rapidly decreased and downstream consumption increased. In terms of the fundamentals, a minor improvement on the supply side has resulted from the restart of operations at aluminum smelters in Sichuan, Guizhou, and other locations. As of March 23, the average inventories of aluminum ingots in China’s eight main markets totaled 1.13 million mt, down 47,000 mt from March 20 and 85,000 mt from the previous week.

About Us:

Procurement Resource offers in-depth research on product pricing and market insights for more than 500 chemicals, commodities, and utilities updated daily, weekly, monthly, and annually. It is a cost-effective, one-stop solution for all your market research requirements, irrespective of which part of the value chain you represent.

We have a team of highly experienced analysts who perform comprehensive research to deliver our clients the newest and most up-to-date market reports, cost models, price analysis, benchmarking, and category insights, which help in streamlining the procurement process for our clientele. Our team tracks the prices and production costs of a wide variety of goods and commodities, hence providing you with the latest and consistent data.

To get real-time facts and insights to help our customers, we work with a varied range of procurement teams across industries. At Procurement Resource, we support our clients with up-to-date and pioneering practices in the industry to understand procurement methods, supply chains, and industry trends so that they can build strategies to achieve maximum growth.

Contact Us:

Company Name: Procurement Resource

Contact Person: Christeen Johnson

Email: sales@procurementresource.com

Toll-Free Number: USA & Canada – Phone no: +1 307 363 1045 | UK – Phone no: +44 7537 132103 | Asia-Pacific (APAC) – Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA